Hydrogen will play a key role in securing an eco-friendly energy supply in the future. The global demand for hydrogen will increase significantly over the next decades, and Germany in particular will depend on hydrogen imports from both European and non-European countries.

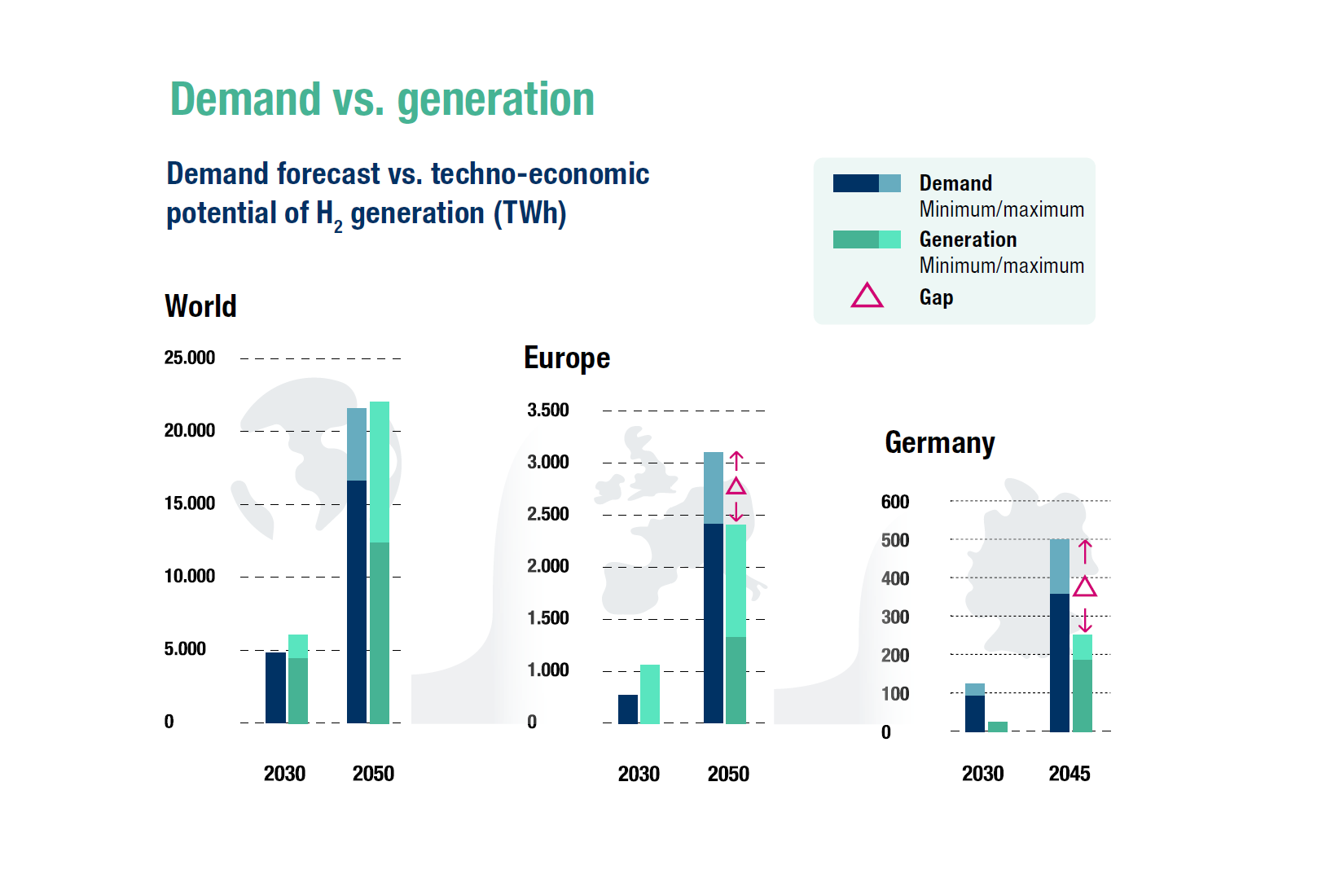

A number of studies and forecasts indicate a growing global demand for hydrogen, from just over 3,000 terawatt hours (TWh) today to approximately 5,000 TWh by 2030, with only roughly 50% being produced by eco-friendly methods and the remainder being generated by conventional means. This figure will rise even further to between 17,000 – 22,000 TWh of hydrogen up until 2025, by when it will have to be produced in a climate-neutral way.

While this may seem an ambitious goal from today’s perspective, these quantities are essential to adequate climate protection and a carbon-neutral energy supply. The global potential for the generation of hydrogen has been projected to even exceed the required quantities. Technically speaking, more than 1,500,000 TWh of green hydrogen could be produced annually by 2050 from renewable energies like wind, solar and water electrolysis, according to a study by the International Renewable Energy Agency (IRENA).

While this so-called techno-economic potential admittedly decreases where the simulations include economic aspects, it still exceeds the projected demand. Various studies and simulations that take into account factors like supply and demand as well as trade relations and technologies assume that it is possible to produce between 1,200 and 5,300 TWh of hydrogen by 2030, and that production will multiply to between 12,300 and 22,700 TWh by 2050.

About 10 – 14 per cent of the global demand for hydrogen will originate in Europe. According to the European Hydrogen Backbone, hydrogen demand in the European Union (EU) will reach about 340 TWh annually as soon as in 2030, with most demand coming from the industry, and could go up to between 2,200 and 3,100 TWh by 2050. While in 2030 the generation potential will continue to exceed demand – which could still be met by production in Europe – there is no doubt that importing hydrogen from elsewhere in the world will be necessary in the long term.

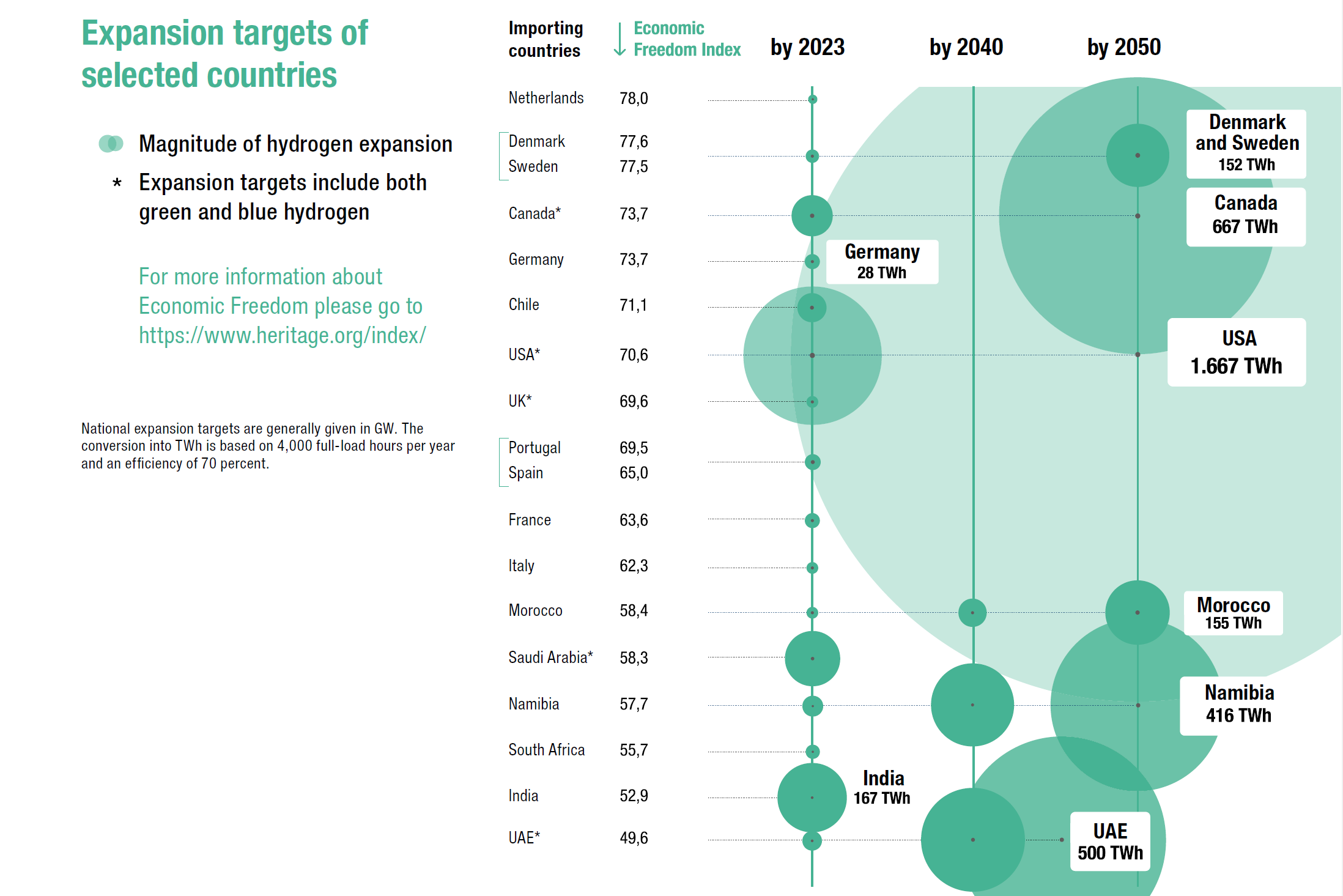

The imbalance between supply and demand is even more pronounced in Germany. The assumptions made by the Nationale Wasserstoffstrategie [National Hydrogen Strategy, made by the Federal Government of the FRG] – expecting Germany’s demand to be between 95 and 130 TWh in 2030 – serve as a guideline for calculating demand and domestic production. The expansion targets that have been set envisage achieving a minimum of 10 Gigawatt (GW) of electrolyser capacity over the same period of time. Based on 4,000 operating hours per annum and an electrolysis efficiency of 70 per cent, this corresponds to a generation of 28 TWh of hydrogen per year – well below the expected demand. The updated Nationale Wasserstoffstrategie assumes that by 2030, Germany will have to meet between 50 and 70 per cent of its demand by importing hydrogen or hydrogen derivatives. In other words, domestic supply will have to be complemented by imports, which is why the Federal Government is currently developing an import strategy.

The Federal Ministry for Economic Affairs and Climate Action reckons that electrolyser capacity in Germany could reach about 79 – 100 GW by 2045, generating between 190 and 245 TWh of hydrogen per annum, which would meet roughly half the projected demand of 360 – 500 TWh of hydrogen.

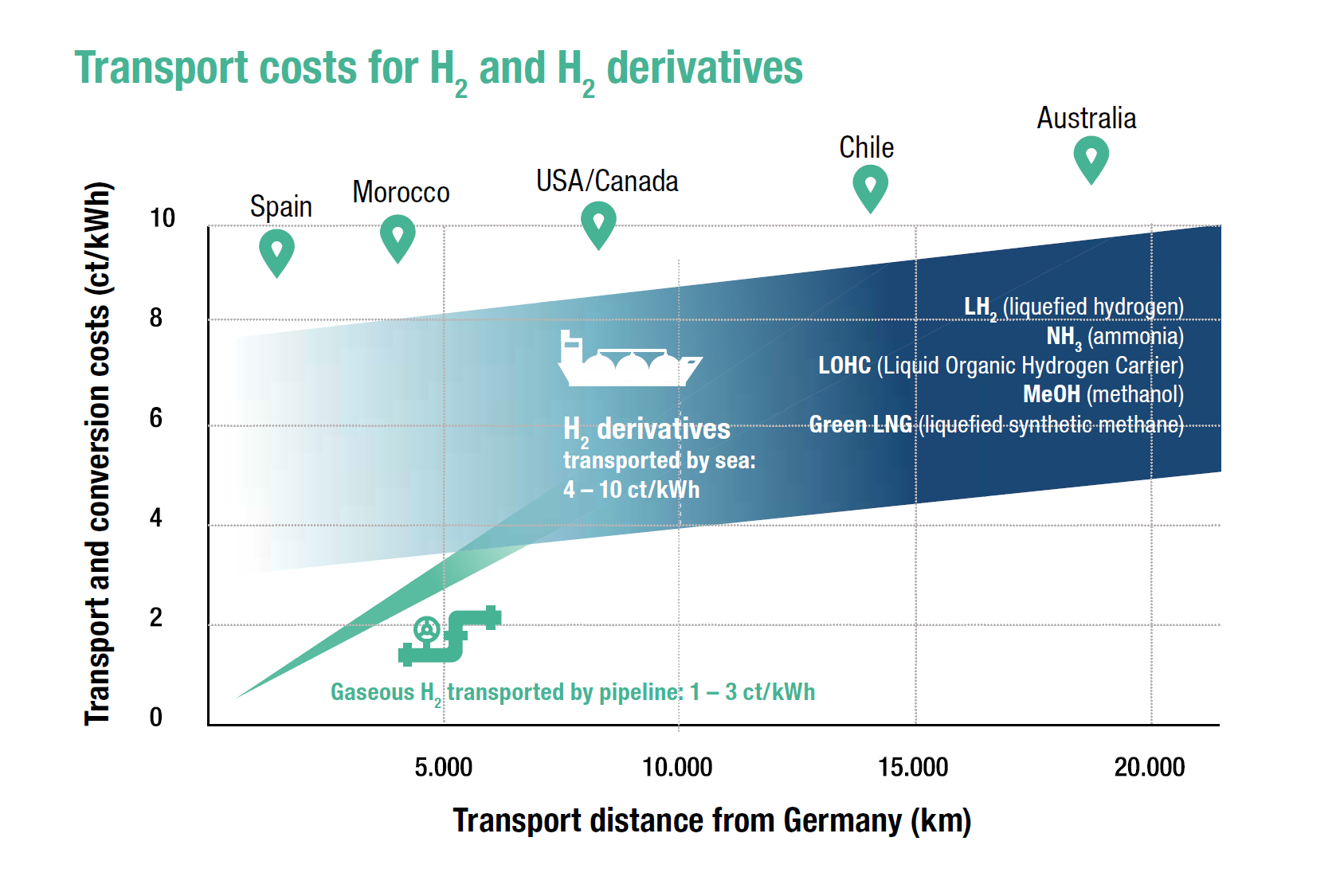

Various means of transportation are available to import large amounts of hydrogen to Germany: By pipeline in the form of gas or – when longer distances have to be covered – by sea in the form of liquefied hydrogen or bound to derivatives. Importing gaseous hydrogen via pipeline would be the option of choice when sourcing from nearby exporting countries such as, e. g., other European or MENA countries (Middle East and North Africa). This will also be the cheapest option in the future. Moreover, existing natural gas pipelines could be repurposed to transport hydrogen.

Transporting hydrogen by sea is an alternative when shipping from more distant regions – especially over distances of more than 6,000 kilometres – that show a great potential for generating eco-friendly hydrogen at low cost. In this case, distance impacts the cost of shipping only marginally. A calculation example for liquefied hydrogen shows that the cost of shipping rises from about 5 to no more than 6 ct/kWh if the distance increases from 10,000 to 20,000km. In other words, if the cost of production is lower by comparison, it may still pay off to transport hydrogen over long distances.

Political intent is key next to technology and the economic environment

As demand continues to grow, imports of carbon-neutral hydrogen will play a crucial role in the context of eco-friendly energy supply. In addition to the eligible regions’ techno-economic generation potential, the answer to the question of how much can be imported from the different regions ultimately also depends on political goals and strategies.

The most ambitious expansion targets have been set by the US, which intends to produce about ten million tons of “clean hydrogen” or 333 TWh of energy per year by 2030. For the US government, the definition of clean hydrogen encompasses the production of both green hydrogen from electrolysis and renewable or nuclear energy and the generation of blue hydrogen by steam reforming of methane and the subsequent capture and storage of the carbon (Carbon Capture and Storage, or CCS for short) that is produced in the process. These methods are meant to generate 1,650 TWh of hydrogen per annum by 2050.

While Norway, Australia, South Korea, Japan and Brazil have already developed strategies for using and generating hydrogen, these countries have not yet defined any specific expansion targets. Other countries such as Indonesia or Egypt, for instance, are currently developing hydrogen strategies and should, therefore, also be considered potential suppliers of hydrogen.

Generation potential exceeds demand for hydrogen

Next to the political goals, the carbon-neutral hydrogen production projects that have already been announced also merit attention. The number of such projects has been continuously and significantly increasing in recent years, as have the planned production capacities. If all projects are implemented as planned, about 1,300 TWh of eco-friendly hydrogen – one quarter of which would be blue hydrogen – could be generated globally by 2030, according to an International Energy Agency (IEA) report. Australia, North America and Europe plan to provide the most production capacity. If Australia’s projects are implemented, that country alone would produce an export volume of at least 250 TWh per year. This would easily make Europe the biggest importer of hydrogen at about one third of the announced hydrogen production volume. Although this is equivalent to only a fraction of the projected demand, there are some positive signs: The generation potential by far exceeds demand, the hydrogen economy has a very positive momentum and last but not least, a constant stream of new projects is being announced that envisage greater production capacities by 2030 – 2023 alone saw a 60 per cent increase over the previous year.

Whether it makes economic sense to import hydrogen from a certain country depends not only on the means of transport and the associated cost. The decisive factor, rather, is the total cost or cost of provisioning, from hydrogen production to the arrival of the product at the final destination. In the case of hydrogen, this cost also includes – in addition to the shipping costs, by pipeline or sea – the costs incurred in the exporting country in the process of generating hydrogen and converting it into derivatives. The costs of production of green hydrogen vary greatly, depending on the country of origin and the studies performed. By 2030, they could range between 3.5 and 7 ct/kWh, decreasing to between 2 and 4 ct/kWh by 2050.

Australia and Latin America prove to be particularly favourable countries, and this is also true for the MENA region. If transport by pipeline is not an option due to long distance, the cost of hydrogen production, the choice of derivative and the associated cost of conversion will determine the price for importing the energy carrier to Germany.

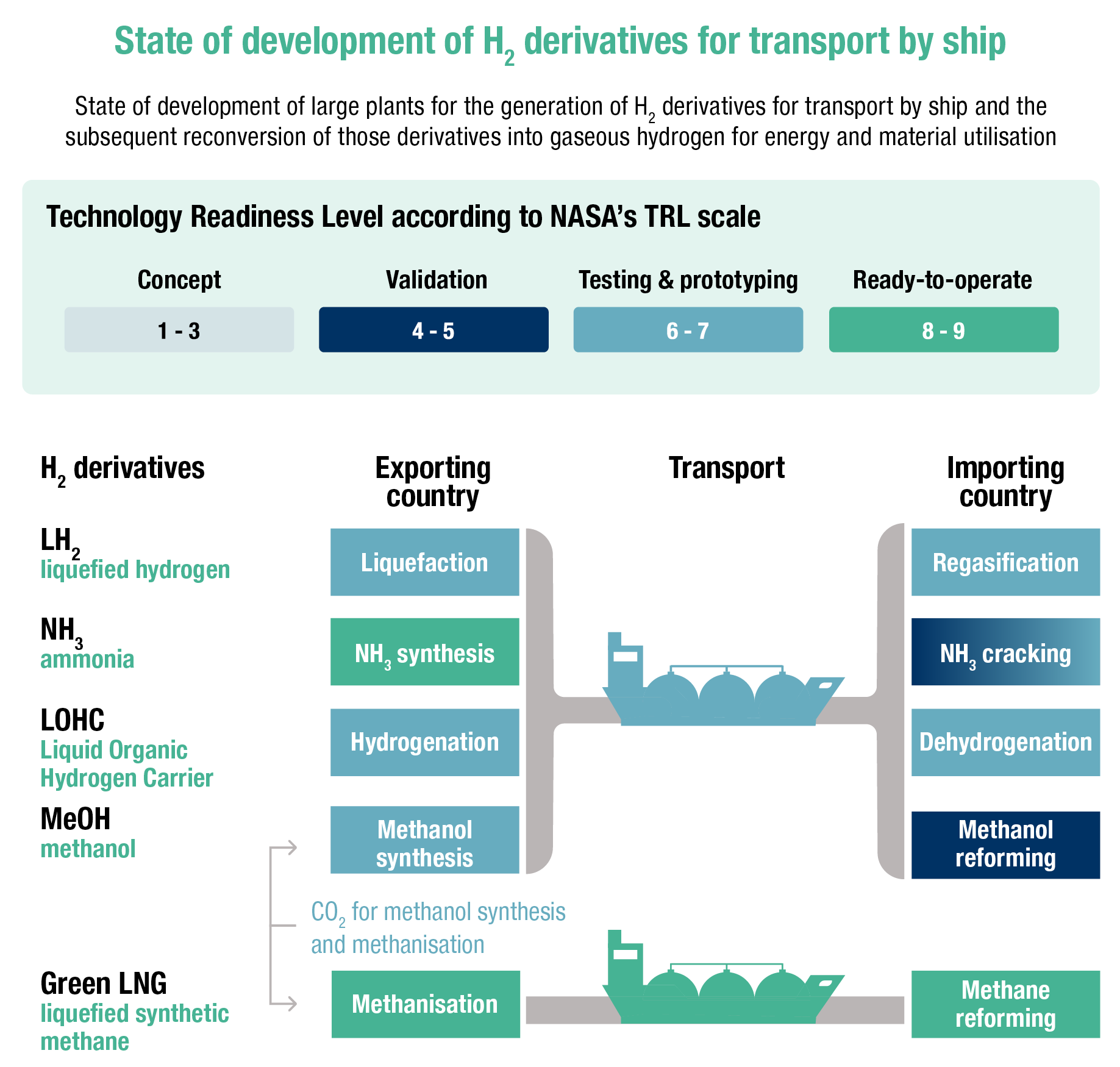

The decision in favour of one supply corridor over another depends not only on the potential cost of provision associated with hydrogen imports. The availability of the required technology for e. g., liquefying hydrogen or converting it to derivatives such as ammonia, methanol or LOHC (Liquid Organic Hydrogen Carriers), also plays a significant role. The best indicator is the Technology Readiness Level.

Most means of transport include process steps that are not yet available on an industrial scale. Above all, the process for reconverting the derivatives to gaseous H2 in the country of import still has a low Technology Readiness Level. The number of suitable ships offering sufficient transport capacity to carry large quantities of energy is currently too small, the only exception being ships for transporting liquefied methane, i. e., LNG.

The “Green LNG” process chain (hydrogen is methanised, i. e., converted to natural gas by adding carbon dioxide (CO2), and subsequently liquefied to LNG) is the most advanced of its kind in technical terms. This product offers the advantage of being able to continue to use already existing LNG terminals. Admittedly, CO2 management still poses a problem because it has not yet been implemented on the necessary scale.

In the long term, however, transporting hydrogen in liquid form (LH2) has the highest rate of utilisation and is therefore the most efficient method. The industry already uses liquefaction technologies, but these are not yet available on the large scale required for the enormous, expected shipping volumes.

Importing hydrogen and hydrogen derivatives to Europe and Germany requires the rapid construction of dedicated terminals. In contrast to handling facilities for primary materials – e. g. ammonia – that are required by the chemical industry, there are no terminals available on the scale required for handling energy imports. The only projects that exist include the occasional plan for constructing ammonia and LOHC terminals; consequently, more investment and more plans are urgently needed.

Only a limited number of ships is available for transporting most hydrogen derivatives (except methane), and these are not suitable for carrying large bulks of freight and/or energy. Such ships, however, would be needed to service the required import volumes.

The recovery of hydrogen from derivatives like ammonia, methanol and LOHC requires developing industrial-scale plants that are big enough to accommodate high volumes of energy imports and operate in accordance with the appropriate standards. So far, experience has been confined to the operation of smaller plants.

An extensive CO2 shipping infrastructure needs to be developed for the production of hydrogen derivatives, i. e., methane and methanol, and the urgently required blue hydrogen as well as for the carbon derivatives required by the chemical industry. At the same time, CO2 removal processes need to be established for all industries.